Stock Market Forecast for the Next 6 Months: Volatile, Bloody… or the Last Breath Before the Roar?

April 15, 2025

Introduction: Extremes Are the Norm, Not the Exception

This market thrives on extremes—yet most only recognise them when prices are soaring, not when they’re crashing. That’s why traders piled into TSLA, AMD, TSM, QCOM, AMAT, and ASML near their highs, convinced the AI hype was gospel. The assumption? These stocks had no ceiling, destined to soar past the moon, then the sun, and straight into the next solar system.

But here’s the part most never see coming: the equation must balance. When the illusion of endless upside shatters—and it already has—those same cognitive biases reverse. The crowd that screamed “new paradigm” now whispers “doom.” Trapped in a carousel of narrative fallacy, loss aversion, and herd mimicry, they only recognise the bottom after it’s long passed.

So what now? Six months of chop? A final bleed-out before liftoff? Or another cruel fakeout designed to stir hope before wrecking it? Let’s break it down.

Sentiment Snapshot: Fear Still Rules, But That’s Not Bearish

For four weeks straight, bullish sentiment barely rose above 20%, dipping as low as 17.5% on March 17—the day bearish readings peaked at 60%. Even now, as optimism creeps back toward 25%, the crowd remains deeply suspicious. Neutral sentiment is swelling, sure, but bears are still in control psychologically.

One striking observation: the SPX shed 10% in just 20 trading days—an ultra-fast drop that’s only happened five times before. Historical data reveals that within roughly 90 days (with an average of 60 days), the market always rebounded into positive territory. With sentiment, psychology, and history aligned, this correction is far from the apocalypse the crowd fears. Market update, March 17, 2025

This is important. Historically, when pessimism saturates the narrative like this, the market doesn’t implode—it stabilises, then rallies. Every time the S&P 500 has dropped 10% in just 20 trading days—something that’s only happened five times in decades—it has rebounded into positive territory within an average of 60–90 days.

Translation? This isn’t the end. It’s the beginning of the next misdirection.

The Illusion Must Hold a Little Longer

On two separate days in the last 9 trading sessions, SPX up volume exceeded 90%. That’s not noise—it’s a historically rare, bullish trigger that doesn’t show up during standard corrections. It signals aggressive buying beneath the surface, even as sentiment remains frozen in fear.

Here’s what’s unfolding: the market’s biggest players need to sell into strength. But to do that, they need believers—optimists who still think “buy the dip” is a commandment carved in stone. That belief is fragile right now. So the illusion must be revived, just enough for sentiment to surge past 60%, maybe even 70%. That’s when they’ll really start selling.

These markets are no longer traditional markets. They’re a casino—and 90% of the players are high on every mind-altering substance known to humanity. They truly believe it’s different this time. And that’s exactly why it isn’t.

Staggered Unloading: The Top in Slow Motion

Watch closely. The topping process isn’t sudden—it’s orchestrated. The big money doesn’t dump everything at once. That would break the spell. Instead, they run a staggered pattern:

- Push the market up → unload a batch → let it dip.

- Push it again → unload another batch → another dip.

- Repeat. Until only the last lot remains.

That final tranche? It’s sacrificial. It’s used to keep the illusion alive. It creates what appears to be a bullish channel, but it’s actually a slow-motion distribution top. Once the euphoria peaks—past 60%, maybe 70%—and the last wave of retail capital piles in, that’s when gravity reasserts itself.

Until then? More bait. More rallies. More belief.

False Peace or Final Panic? Two Paths Ahead

With the SPX recently dipping into the oversold zone on the weekly charts, two scenarios emerge:

- Sideways Drift: A frustrating grind. No sharp drops, just a slow bleed until technical indicators hit exhaustion.

- Sharp Drop to 4800 Range: Panic hits. Sentiment collapses. A short-term bottom is carved in panic—and ironically, that sets up the strongest rally of the year. Market Update March 27, 2025

Which one plays out? Unknown. Only entities from the next dimension have that insight. But either way, the odds favour an upside reaction once the setup is complete.

Strategy: Pullbacks Are the Play—for Now

Until euphoria arrives, pullbacks are gifts. For options traders, selling puts on fundamentally strong stocks during periods of market panic remains a rational contrarian play. You either collect premium or buy cheaper—both are better than chasing strength.

For equity investors? Patience. Scaling into fear, not hype, remains the edge. Wait for volume signals, sentiment breaks, and momentum divergences. The bloodier it gets short term, the better the long setup becomes.

Yes, a reckoning will come—but not before a period of euphoric misdirection. A celebration that feels like salvation, but is seduction.

Contrarians Hunt Alone

Chaos isn’t danger—it’s data. When the herd rushes left, look right. When they dump quality because headlines spooked them, grab it. Be the one pulling the trigger while others are paralysed. As Heraclitus said: “Change is the only constant.” Learn to surf it or get crushed by it.

Power Stocks: The War Chest

Forget the “hot picks” nonsense. Build your arsenal methodically:

- Sectors with tailwinds: AI, energy, defense, rare metals

- Balance sheets with muscle: cash-heavy, low-debt killers

- Moats: monopolies, brand loyalty, patents—unassailable edges

- Valuations that lie in your favor: P/E, P/B, and DCF set to detonate under the right conditions

- Technical cues: breakout patterns, MACD turns, moving average clusters—when psychology meets setup

The crowd misses these every cycle. Their loss. Your gain.

Long-Term Chart Mastery: Where Giants Place Their Bets

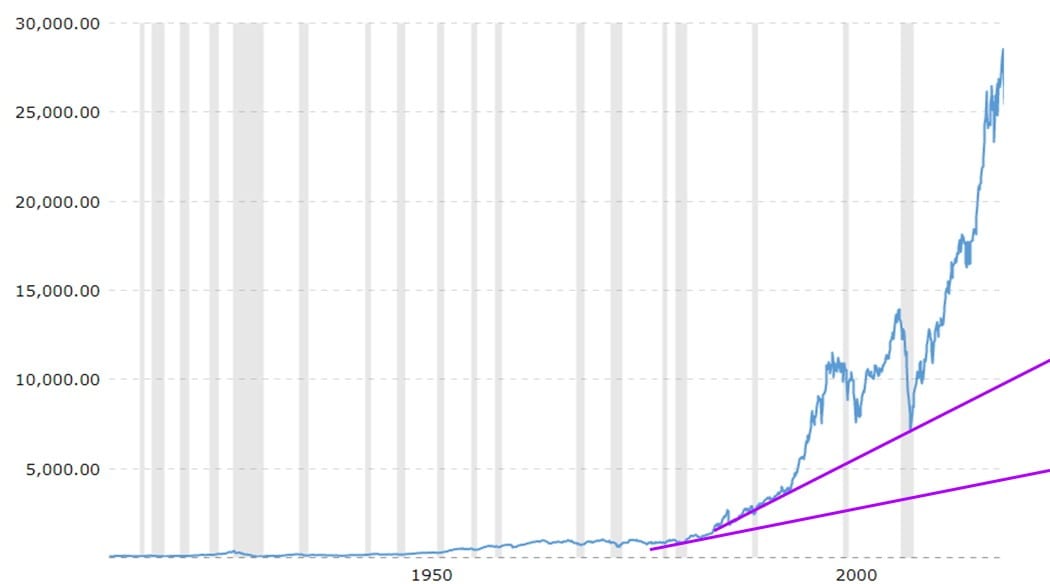

Draw a simple long-term trend line. That’s your map. Whenever price dips near or below it—especially in a 12–20 year chart—don’t hesitate. The bigger the deviation from the trend, the more outsized the opportunity.

Charts with decades of data—especially the one spanning 80+ years—highlight this clearly: pullbacks are rare moments of asymmetric reward. Use sentiment over 55 as your trigger. These are the moments you buy when others whimper.

Conclusion: Mass Delusion, Whiplash, and the False Signal of Fear

Markets don’t crash in fear. They crash in overconfidence.

Panic isn’t the signal—it’s the purge after the signal was ignored.

The real move doesn’t start with terror. It starts with triumph.

When the crowd chants, “We figured it out. This time, we win.”

That’s the bait. That’s the beginning of the end.

COVID was the great rehearsal.

Fear was maxed. The crowd froze.

And yet… the market bottomed. Hard. Reversed. Exploded upward.

Because markets don’t collapse from fear. They collapse into it.

That’s the inversion nobody sees coming.

Everyone thinks fear = downside.

But in vector logic, fear is kinetic release. It clears the field.

True downside emerges when confidence ossifies—when belief calcifies into certainty.

Euphoria is the disease. Fear is the fever. And fever breaks.

And now?

The narrative grid is overloaded:

→ “End of empire.”

→ “Dollar is dead.”

→ “AI will eat the world.”

→ “Collapse is inevitable.”

Every new doomsday headline isn’t a warning—it’s an exhaust valve.

And when everyone is screaming collapse, it means something else entirely—

The selloff has already happened emotionally. The market is just catching up to the rebound.

Because bottoms aren’t logical. They’re emotional inversions.

And tops? They’re not euphoric parades.

They’re victory laps before vaporization.

You want to know when the hammer really drops?

When TikTok traders start lecturing the Fed.

When macro bros speak with the arrogance of prophets.

When retail doesn’t just play the game—they think they own it.

That’s the kill zone.

The vector lines converge: arrogance, over-leverage, false security.

But here’s the cruel trick—AI may buffer the blow.

The crash might not be cinematic.

It might be surgical, algorithmic, cold.

Less like a freefall.

More like an organ failure.

Still, there will be blood.

There’s always blood.

So what now?

Pullbacks = opportunities.

Because fear is trending.

Because doomsday is a brand now.

And when collapse becomes a narrative commodity, it’s no longer predictive—it’s priced in.

Crowds don’t chant bottoms. They scream past them.

And all those screaming prophets of doom?

They’re not ahead of the curve.

They are the curve.

A sine wave of herd mimicry, repackaged as insight.

They are not the ones calling the turn.

They’re the liquidity for the turn.

They’re not making noise.

They are the noise.